A summary of a summary of the EU Taxonomy challenge – a summary

If in doubt, yes, this is a summary!

When approaching, and trying to digest, the regulatory framework that in general terms is called the “EU Taxonomy” for sustainable finance, you quickly realize that many thousands of pages have already been produced and that many more, most certainly, are under way. Adding to the sheer volumes of text is also the challenge that most readers approach the task directly from the perspective of how to apply the taxonomy for their own operations. Within a blink you find yourself tangled in a myriad of almost impenetrable measures and details. To feel overwhelmed in such a situation is perfectly human.

This reflection is an attempt to provide a brief “helicopter perspective” of the EU Taxonomy terrain for those who need to, or are just interested in, entering the land of European sustainability reporting and compliance.

To begin from the very top altitude, the taxonomy is part of the Sustainable Finance Initiative which in itself is part of the European green Deal, one of The European Commission’s top priorities for 2019-2024 to make EU climate neutral in 2050. The purpose of the taxonomy is to create clear definitions for “sustainable economic activities” and a common classification system.

Working with the EU taxonomy is clearly a non-trivial task. This, in part, is proven by the uncountable consultants’ and analysts’ reports on the topic, doing their best to interpret the communications and regulations from the EU for the benefit of financial and industry practitioners. One obvious reason for confusion, and challenging implementations, is the simple fact that the taxonomy is not yet ready. It is a work in progress, a fact that the regulators certainly make no attempt to hide but that is not apparent at first glance.

In March 2020 the EU Technical Expert Group (TEG) published the “TEG final report on the EU taxonomy”. An earlier paper (supplementary report) from 2019 labeled “Using the taxonomy” is a more condensed reading about how to apply the taxonomy. Both are necessary documents to sooner or later acquaint yourself with if you embark on the EU Taxonomy journey. Another piece that is very valuable to read is the PRI Testing the Taxonomy document. Still, most of the work lies ahead. On October 15 and 16, 2020, the first inaugural meeting of the Platform on sustainable finance was held. The Platform can be considered as the permanent continuation of the former TEG with the mandate to further develop and maintain the taxonomy for global fulfillment of the Sustainable Development Goals. For those interested in the Taxonomy, make sure to follow the workings of the Platform.

Finalized or not, the Taxonomy is made up by a well-defined umbrella structure that most likely will not change over the immediate foreseeable future. The taxonomy lists economic activities based on NACE codes and each such activity should have performance criteria for its contribution to six environmental objectives.

The six environmental objectives are:

- Climate change mitigation;

- Climate change adaptation;

- Sustainable use and protection of water and marine resources;

- Transition to a circular economy, waste prevention and recycling;

- Pollution prevention and control;

- Protection of healthy ecosystems.

You can see the taxonomy as a matrix with the NACE codes on the Y-axis and the environmental objectives on the X-axis:

So far, very straight forward!

Now, let’s add the first layer of complexity. The regulator uses the term “taxonomy eligible” meaning that an economic activity (a given row in the matrix above) must “contribute substantially” to at least one of the six environmental objectives and “do no significant harm” to the other five in order to be considered as sustainable in a formal meaning. In addition, all economic activities must meet “minimum social safeguards”, which in turn is interpreted as meeting the ILO’s Decent Work agenda, to be considered eligible.

When it comes to labelling an activity as Substantially Contributing, one of three alternative requirements need to be fulfilled for eligibility:

- Own performance – activity already eligible, or

- Enabling activity – activity contributing to transition towards eligibility but not yet operating at that level, or

- Transition activity – activity that enables those above.

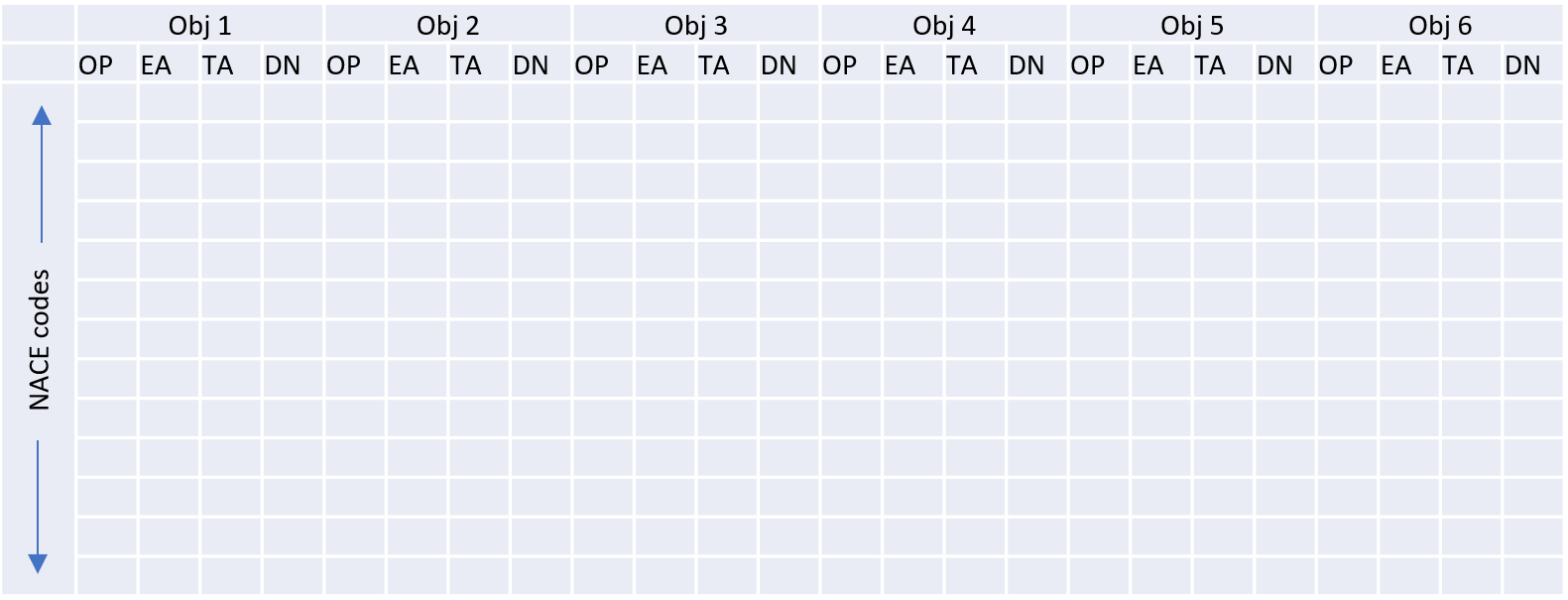

Our matrix has now grown in the sense that each environmental objective column has got four sub columns each:

- OP-Own performance

- EA-Enabling activity

- TA-Transition activity

- DNSH

NACE uses four hierarchical levels:

- Level 1: 21 sections identified by alphabetical letters A to U;

- Level 2: 88 divisions identified by two-digit numerical codes (01 to 99);

- Level 3: 272 groups identified by three-digit numerical codes (01.1 to 99.0);

- Level 4: 629 classes identified by four-digit numerical codes (01.11 to 99.00).

In total we thus have a matrix with 629×24=15 096 matrix elements to manage.

Why all this?

Let say you are running a company manufacturing socks and that that is all you do. Let’s also assume that there is a NACE code for manufacturing socks. No, we have not checked if there is but if there is, all you now need to do is to see if your NACE (manufacturing of socks) contribute substantially to one of the six objectives, either OP, EA or TA and that it does not do any harm to the others (DNSH). And, oh yes, do not forget, you are compliant with all the ILO Decent Work items as well, right? If yes, great! Your company is now eligible for investment from funds that has labelled themselves as sustainability/green funds. Even one negative on the DNSH or the ILO and your eligibility is gone.

Your ability to be “taxonomy eligible” has a rapidly growing impact on your cost of capital and, going forward, maybe even your fundamental access to the capital market, both for equity and debt.

That’s why!

Still so far so good and perfectly clear, structure wise. Just 15 096 matrix elements to relate to from a “helicopter perspective”. Truly, no sarcasm intended here! After all, each company only need to focus on a smaller subset of the NACE structure so it is not as unmanageable as it can seem at first glance. To this point the regulators have approached the task of sustainability in a manner we can all applaud. It is not complex; it is perfectly comprehensible.

The challenge arises when it is time to select an economic activity and assess its eligibility. In order to do that, each matrix element needs a “Technical screening criteria” with set requirements for determining Substantial Contribution and Doing No Significant Harm (DNSH). You cannot just argue your way around that your socks manufacturing is eligible. You need to be exact in why it contributes substantially to e.g. “transition to a circular economy, waste prevention and recycling” and do no significant harm to the rest, e.g. the “protection of healthy ecosystems”.

In order for the system to work, the regulator hence need to specify 15 096 exact criteria, defined in a way that is reasonably easy to understand and apply. As of the date of this note (January 2021) only objectives 1 (70 economic activities) and 2 (68 economic activities) have concrete criteria defined but the rest are being continuously developed. The simplicity to apply these is however being debated but this is also where this reflection stops as it is where the complexity and uncertainty of the taxonomy increase exponentially. We will monitor such debates and may be back with more in due course but recommend all companies to acquaint themselves with the structure above and to begin the process of understanding the contents of relevant matrix elements for your particular business.

Inzyon’s view is that there is a long road ahead until the technical screening criteria are complete and useful (although it will never be entirely complete as it is a work in progress for future generations). Also, we will not be surprised if the list of objectives grows from six to a slightly higher number. After all, the taxonomy ultimately aims at supporting the fulfillment of the UN 17 Sustainable Development Goals so that it will grow slightly is probably not too wild a guess.

An end note is that this probably is the most powerful tool hitherto launched by regulators globally to enforce a more sustainable world. Today, it is almost only the financial community that is “taking the heat” but is will very soon spill over directly on the reporting companies themselves that will be required to breakdown all revenue streams, as well as debt financed assets, in the NACE categories and for each applicable category maintain reporting on taxonomy eligibility.

Bottom line; what is now being implemented as harsh requirements on asset/fund management reporting will eventually affect all companies throughout their organizations in ways that resembles those of the growing quality standards and requirements over the past decades. This is not a fad that will blow over, better start now to be prepared than be shocked and surprised in a few years from now when it all becomes legislation.

Inzyon Reflections is a series of brief thoughts and observations with a bearing on insights management in general and, every now and then, sustainability matters in particular. For additional Inzyon Reflections, see here.